Dario Fiore

Principal Consultant, Director

Der Sach-Haft Offertprozess kann durch Anpassungen für Endkunden einfach und schnell gestaltet werden. Mögliche Lösungsansätze dafür folgen in diesem Blog.

Autor: Dario Fiore

Digitale Vertriebskanäle werden für Sachversicherungen immer wichtiger. Für Kundinnen und Kunden ist im digitalen Offertprozess einerseits eine hohe Benutzerfreundlichkeit wichtig und andererseits, dass sie mit möglichst wenig Angaben rasch ein erstes Angebot inkl. Preis erhalten. Offertprozesse sind allerdings oft lang und komplex, was zu unnötigen Absprüngen führt und in einer tieferen Abschlussquote (Conversion Rate) und verpassten Leads resultiert. In diesem Blog soll ganz konkret anhand des Offertprozesses für Motorfahrzeugversicherungen aufgezeigt werden, wie man das besser machen kann.

Was ist eine wichtige Herausforderung, die es in einem digitalen Offertprozess für Motorfahrzeugversicherungen zu lösen gilt?

Kundinnen und Kunden möchten möglichst schnell und durch möglichst wenig Eingaben wissen, ob das Produkt ihren Bedürfnissen entspricht und mit welchem Preis sie ungefähr rechnen können.

Nachfolgend werden vier Lösungsvorschläge aufgezeigt, um das Bedürfnis der Kundschaft im Offertprozess einer Motorfahrzeugversicherung zu adressieren.

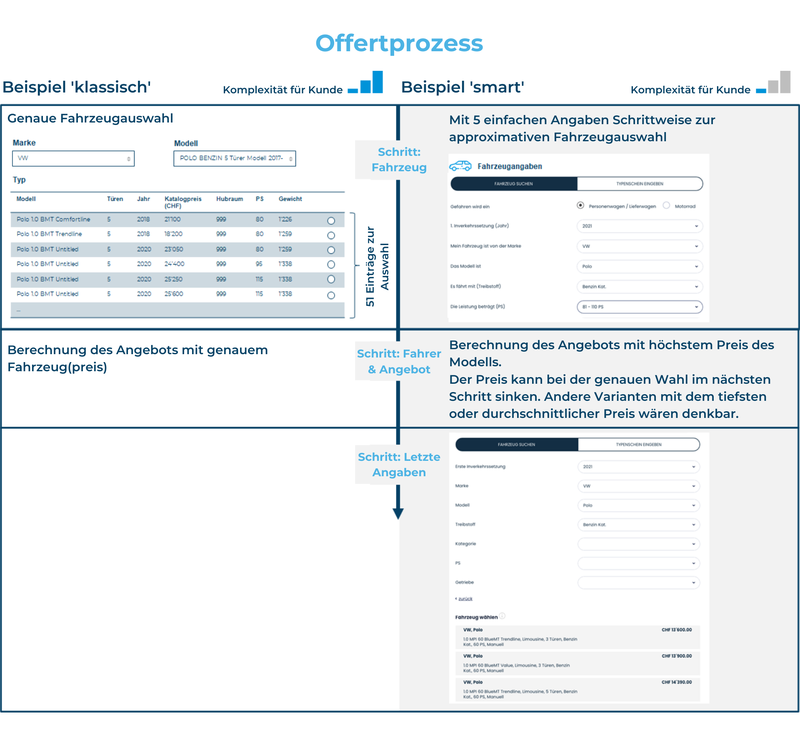

Bei einigen Marken und Modellen gibt es über 50 Detailtypen, die sich allerdings oft nur geringfügig im Preis unterscheiden. Wird der Kunde bereits am Anfang des Prozesses mit einer zu grossen Auswahl konfrontiert, bricht er möglicherweise den Prozess ab. Falls erforderlich, kann die genaue Wahl des Fahrzeugs auf einen späteren Prozessschritt nach der Angebotswahl verlagert werden. Der Kunde hat sich dann bereits für ein Angebot entschieden und bricht den Prozess seltener ab.

Der Kunde kann diese Werte später im Prozess anpassen, wenn er sich bereits für ein Angebot entschieden hat. Zur Identifizierung von möglichen Standardwerten helfen Statistiken der häufigsten Werte pro Merkmal über die bisherigen Offerten.

So sind beispielsweise die Antragsfragen (bisherige Schäden, Führerausweisentzüge, etc.) für das Angebot nicht erforderlich und sind eher zur Aussteuerung schlechter Risiken gedacht. Der Kunde kann auch später im Prozess an den Vertrieb verwiesen (Lead generieren) oder ganz ausgesteuert werden.

Andere Werte haben allerdings erhebliche Auswirkung auf den Preis. Hier gilt es die Anzahl Eingaben mit der Zuverlässigkeit des Preises abzuwägen.

Eine enge Zusammenarbeit zwischen Aktuariat, Produktmanagement, IT und User Experience hilft, sinnvolle und mögliche Vereinfachungen des Produktmodells zu identifizieren und so die erforderlichen Eingaben zusätzlich zu reduzieren.

Mit den Lösungsvorschlägen lassen sich folgende geschäftliche Wertbeiträge in verschiedenen Dimensionen realisieren:

Customer Value Case

Die initialen Eingaben durch den Kunden reduzieren sich um über 65%. So gelangen diese schnell und einfach zum Angebot und Preis. Gesamtheitlich wird damit eine bessere Benutzerfreundlichkeit geschaffen.

Strategy Case

Die strategischen Ziele wie Differenzierung und Kundenorientierung werden unterstützt.

Revenue Case

Es können neue und bestehende Kunden besser angesprochen sowie Leads generiert werden. Durch die Reduktion der initialen Eingaben wird die Absprungrate stark gesenkt und die Conversion Rate dadurch verdoppelt.

Digitale Vertriebskanäle werden für Sachversicherungen immer wichtiger. In den entsprechenden Offertprozessen möchten Kundinnen und Kunden mit möglichst wenigen Angaben ein erstes Angebot inkl. Preis erhalten. Das wird ermöglicht durch:

Mit diesen Massnahmen können die Conversion Rate optimiert und mehr Leads für den Vertrieb generiert werden. Intuitive, schlanke und benutzerfreundliche Offertprozesse helfen den direkten, digitalen Vertriebskanal der Versicherungen gegenüber Aggregatoren-Portalen wie beispielsweise Comparis attraktiver zu machen und erlauben Differenzierung am Markt.

Werden die beschriebenen Erkenntnisse weitergedacht, dann lassen sie sich teilweise auch auf Offertprozesse für Hausrat- und Privathaftpflichtversicherungen übertragen. Auch dort werden meist viele Eingaben abgefragt, bevor ein Angebot und eine erste Preisindikation unterbreitet wird.

Mit dem API-Strategie Vorgehensmodell schaffen Sie ein einheitliches Kundenerlebnis über alle Kanäle hinweg.