Jonas Wagner

IT Architect

Autor: Jonas Wagner

Der Markt rund um Lebensversicherungen befindet sich im Wandel. Durch die tiefe Zinssituation und den erhöhten Kostendruck müssen Schweizer Versicherer ihre Produktpalette anpassen, um konkurrenzfähig zu sein. Im Speziellen auch, um sich gegen neue Anbieter wie frankly erfolgreich durchzusetzen. Durch die gezielte Verbesserung der Customer Experience und einen transparenten und automatisierten Underwriting Prozess können sie sich aber einen entscheidenden Vorteil verschaffen.

Die Sparte der Lebensversicherungen haben gegenüber Versicherungen wie Hausrat oder Motorfahrzeug ein eher komplexeres Underwriting. Das ist berechtigt, denn es stehen meist hohe Geldbeträge auf dem Spiel und die Laufzeiten der Verträge sind tendenziell hoch (für 3a potentiell 47 Jahre). Aufgrund der hohen Komplexität des Underwritings wagen viele Versicherer den Schritt von einem manuellen zu einem automatisierten Prozess nicht. Es wird jedoch unterschätzt, dass genau dies ein exzellenter Ansatzpunkt ist, um sich mithilfe von Automatisierung durch Customer Experience zu differenzieren und damit ein grosses Potential auszuschöpfen.

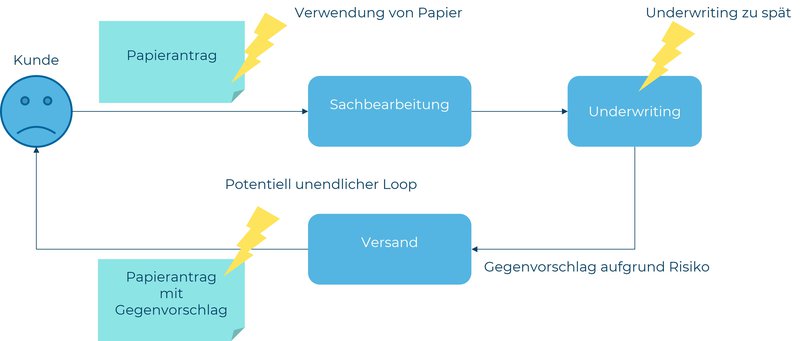

Stellen wir uns folgende Situation vor: Ein Kunde möchte eine 3a Versicherung inkl. Prämienbefreiung, Todesfall und Erwerbsunfähigkeit abschliessen:

Unsere Erfahrungen bei führenden Schweizer Versicherern zeigen, dass gewisse Underwriting-Prozesse Gefahr laufen, Kunden in einem endlosen Loop von Anträgen gefangen zu halten. Dies hat nicht nur eine schlechte Customer Experience zur Folge, sondern ist auch ausserordentlich ineffizient und verursacht dementsprechend grosse Kosten.

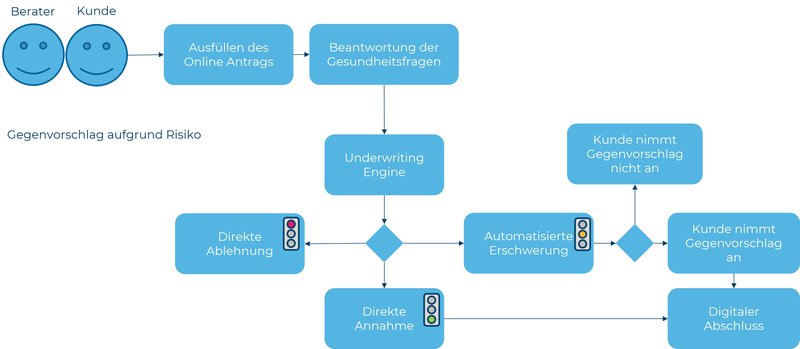

Was kann in so einer Situation unternommen werden? Eine mögliche Lösung für die beschriebene Herausforderungen ist ziemlich offensichtlich: Man kann solch komplexe Underwriting-Prozesse vielerorts komplett automatisieren. Die Entscheidungskriterien für das Underwriting sind für fast alle Fälle standardisiert und quantifiziert. Als Beispiel nehmen wir das Kriterium Raucher ja/nein. Falls ja, bekommt der potentielle Versicherungsnehmer einen Raucherzuschlag. Die Höhe des Zuschlags wird aber nicht willkürlich vergeben, sondern folgt einer bestimmten Logik (z.B. Wie häufig raucht er?). Ergo kann als Kernstück der Automatisierung eine Rule-Engine eingesetzt werden, welche die Fragen und Regeln der Risikoprüfung und Fragen abbildet und verwaltet. Damit beschleunigt sich der Prozess und manuelles Eingreifen ist nicht mehr erforderlich. Vielerorts sind Rule-Engines schon im Einsatz, jedoch entweder nicht im Bereich der Lebensversicherungen oder nicht vollständig in einen automatisierten Underwriting-Prozess integriert.

Die obenstehende Abbildung zeigt beispielhaft eine Möglichkeit der Automatisierung:

Der wesentliche Vorteil ist sicher, dass dank der Automatisierung Kosten gespart werden können. Einer unserer Kunden hat geschätzt, dass mindestens 60% aller Anträge automatisiert verarbeitet werden könnten, sehr wahrscheinlich aber sogar mehr als 90%. Aktuell haben sie mit der Automatisierung noch nicht gestartet. Ein weiterer Vorteil ist, dass der Berater zusammen mit dem Kunde das Underwriting vor Ort durchführen und somit während einem einzigen Treffen zum Abschluss kommen kann. Ausserdem ist die Customer Experience dank dem transparenten Underwriting-Prozess viel angenehmer und (über)trifft die Erwartungen des Kunden.