Lukas Kern

Partner

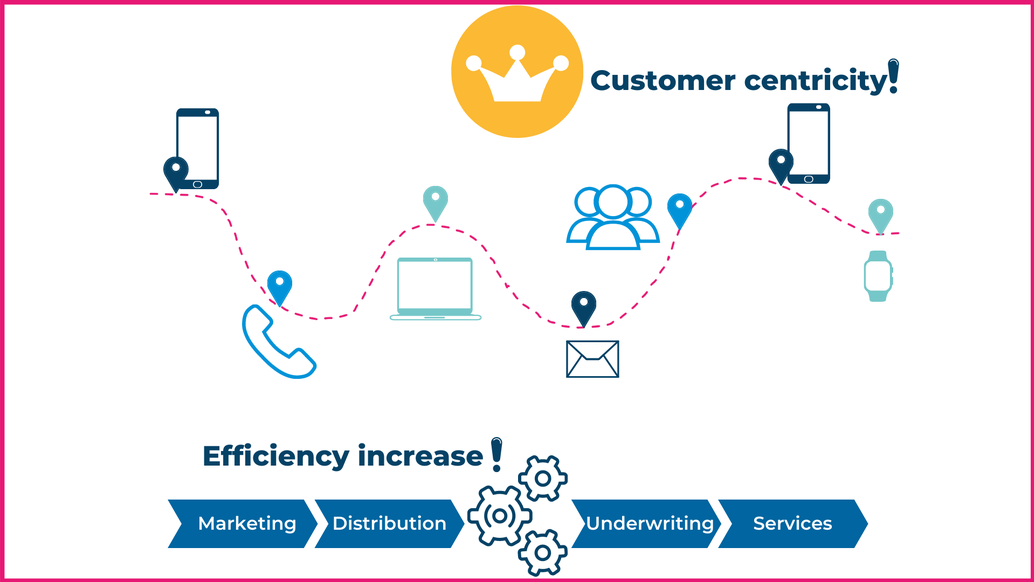

Two trends dominate the insurance industry: Customer centricity to improve the customer experience and increased efficiency in processes to reduce administrative costs. With custom IT solutions based on modern technologies, you can address these trends quickly and sustainably. We support you as a long-standing IT partner in the insurance industry.

More and more customers are taking out insurance policies online and expect this to be possible at any time and for the insurance policy to be issued immediately. With the trend towards insurance on demand and on a daily basis, this demand continues to increase.

The quoting and application process and the seamlessly integrated underwriting process contain manual work steps in many situations. In order for the insurance policy to be delivered to the customer immediately after the online transaction is completed, these processes must be automated holistically; thus, end-to-end instead of partially.

With a flexible set of rules or AI models and agile process orchestration based on microservices, the manual process steps can be automated and seamlessly integrated into the quoting and application system and the related backend systems. In case of seasonal fluctuations, scaling can be performed as needed.

Swiss Re | Innovative digital solutions thanks to efficient cloud-native development: from the digitalization of underwriting to the digitalization of claims processing. Learn more

Property Liability Insurance | Customer Orientation in the Digital Offer Process for Property Liability Insurance. The property liability quote process can be made much less complex for end customers. Learn more

Health Insurance | Achieve big impact through a small process improvement. With end-to-end digitization and omnichannel capability of the offer and application process to more satisfied customers. Learn more

The processes around client services and benefits show great potential in terms of customer focus and process efficiency. Both aspects are addressed in many corporate strategies. While customer centricity contributes to differentiation, increase in efficiency focuses on reducing administrative effort.

Customer centricity and increases in efficiency may compete with each other. The more efficient and automated a process becomes for the insurer, the more company-centric and rigid the process generally becomes and the less personalization and customer-centricity is possible. Accordingly, the two goals must be closely aligned.

Increased efficiency can be achieved by means of end-to-end integration between frontend and backend systems. Customer centricity is achieved by tailoring processes to the customer in the frontend systems and translating these processes to the rigid backend processes via process orchestration.

AXA Schweiz | Increased efficiency through automation and cloud integration: from the digitalization of internal processes to the provision of self-services for end customers. Learn more

Property Liability Insurance | Claims Handling 2.0 in the Motor Vehicle Business: The claim and the associated processing are key moments in the insurance business. The customer wants to be able to interact digitally with the insurer at any time during the settlement of the claim. Learn more

Increasingly, differentiation in the market is achieved by customer experience. This begins in sales, but also includes all downstream processes that the customer experiences over time: customer services, customer benefits and claims management, collection and disbursement. For sustainable customer satisfaction, you can track and actively design the customer journey across all core processes.

Many practices and tools around customer journey management focus on marketing and sales. The challenge in achieving sustainable customer satisfaction lies in the holistic view of the customer journey; thus, from marketing to sales, to client services and benefits, etc.

Using so-called experience dialogs, customer journey situations can be modeled in fine granularity and linked with measures. Thereby, every customer situation can be designed proactively in order to achieve a high level of customer satisfaction. At the same time, up- and cross-selling potential can be identified and addressed.

Customer Experience Management | The supreme discipline among all customer-centric measures. Learn more

Successfully target insurance customers thanks to AI | By using AI, insurers can optimize their marketing processes and achieve a higher hit rate when targeting customers appropriately. Learn more