Dominik Liebmann

Principal Consultant, Director

Die Digitalisierung schreitet in der Finanzbranche mit grossen Schritten voran.

Autor: Dominik Liebmann

Neo-Banken setzen den Standard digitaler Kundeninteraktion. Traditionelle Kernbankensysteme tun sich mit ihrer monolithischen Architektur schwer, mit dieser Entwicklung Schritt zu halten. Avaloqs Antwort darauf ist, ihr bisheriges Kernbankensystem auf einer modernen Microservice Architektur neu zu schreiben. In den folgenden Abschnitten zeigen wir Ihnen auf, mit welchen vier Erfolgsfaktoren Sie die zukünftige Avaloq Kernbankenlösung in Ihre Digitalisierungsstrategie einbinden müssen.

Heutige Banken stehen unter digitalem Druck. Kunden erwarten eine Always-On-Bank, welche sie jederzeit über alle Kanäle (Web, Mobile, Chat, etc.) erreichen können. Regulierer fordern eine Öffnung der Bank und mehr Integration (Stichwort Open Banking). Nur die wenigsten Kernbankensysteme erlauben eine Öffnung und Integration in diesem Masse.

Avaloq, einer der führenden Schweizer Anbieter von Kernbankensoftware, hat diese Entwicklung erkannt und stellt sein Kernbankensystem zukünftig auf eine Microservice basierende Architektur um. Diese umfasst im Wesentlichen folgende Bestandteile:

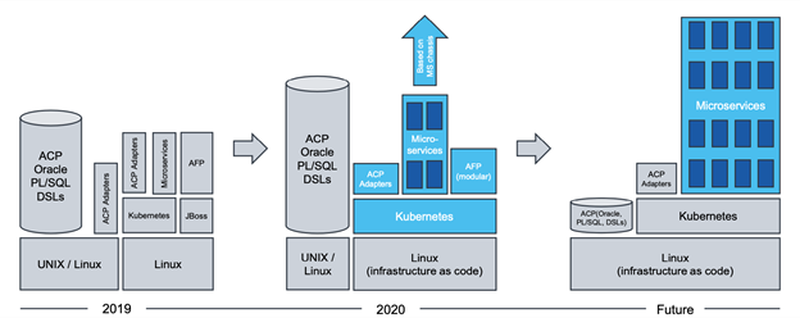

Die gesamte Avaloq Software wird zukünftig auf Microservices basieren, welche auf einer Container Platform (Kubernetes) laufen wird. Avaloq Partner werden angehalten, ihre Software ebenfalls als Microservice auf Kubernetes laufen zu lassen (z.B. Airlock IAM).

Die durch Avaloq Front Platform (AFP) bereitgestellten Funktionen werden abnehmen. Benutzeroberflächen (UI) für Web, Mobile und andere Geräte werden vermehrt durch Avaloq Kunden und Partner erstellt werden.

Die bisher mehrheitlich in PL/SQL erstellte Business Logik der Avaloq Core Platform (ACP) wird aus der Datenbank heraus migriert. Neu wird die Geschäftslogik in Microservices verpackt.

Durch den Umstieg auf die neue Architektur verspricht sich Avaloq für seine Kunden folgende Vorteile:

Kürzere time-to-market und höhere Flexibilität (business agility) durch kleinere Systemeinheiten (self-contained system)

Höhere Innovation durch Wiederverwendung bestehender Funktionen und Self-Service

Mehr Effizienz durch Verwendung von Standard Technologien

Höhere Qualität, Verfügbarkeit und Releasing durch modulare Architektur

Um die Vorteile des neuen Kernbankensystems von Avaloq für sich zu realisieren, müssen Sie Ihre bisherige Integrationsarchitektur überdenken. Denn die Auswirkungen dieses Architekturwechsels sind enorm und haben für Sie weitreichende Folgen:

Mit dieser Modernisierung ihrer Applikation sieht sich Avaloq für die weitere Digitalisierung des Bankings gerüstet. Als Avaloq Kunde müssen Sie mit der Veränderung Schritt halten und Ihre Mitarbeitenden auf den neuen Technologien ausbilden um Migration, Weiterentwicklung und Betrieb Ihrer Kernanwendung sicherzustellen. Das bisherige typische Avaloq Entwicklerprofil wandelt sich von einem PL/SQL-Experten mit datenzentrierter Sicht zu einem T-Shaped DevOps Engineer, der in Services und APIs denkt.

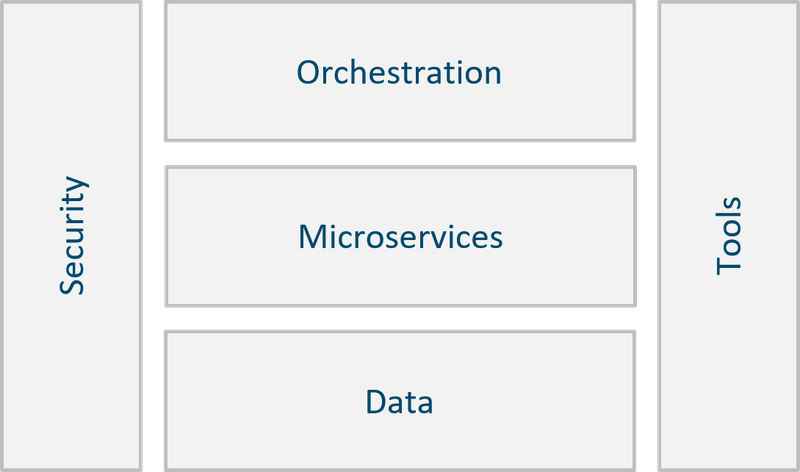

Der Einsatz von Microservices benötigt neben den entsprechenden Skills eine geeignete Integrationsarchitektur. Diese deckt dabei die folgenden Anforderungen ab:

Microservices zeichnen sich durch eine lose Kopplung mittels APIs aus d.h. durch Kombination bestehender Funktionen lassen sich leicht neue Angebote erstellen. Zum Beispiel ein individuelles Finanz-Dashboard für die Konto- und Transaktionsverwaltung durch die Integration von Microservices. Die Orchestrierung der Microservices übernimmt ein API Gateway.

Mit der Auftrennung der Logik aus einem Monolithen in einzelne Services werden auch die Daten verteilt. Sie befinden sich in direkter Nähe zu den Microservices, meist in Form von leichtgewichtigen Datenbanken oder Caches (z.B. PostgresSQL, Redis). Die Datenverteilung d.h. die Bereitstellung der Daten übernimmt Kafka als Daten-Backbone.

Der Zugriff auf Microservices durch Anwender und andere Microservices muss kontrolliert werden (Access Management). Andernfalls können Daten ungehindert abfliessen. Für eine Bank, die vom Vertrauen ihrer Kunden lebt, ein unvorstellbares Szenario.

Ein effektives Access Management setzt dabei auf ein modernes Identity Management, welches ein Föderieren von Identitäten unterstützt. Dieses wird um Mechanismen für eine Policy-Verwaltung und deren Durchsetzung ergänzt. Dadurch wird definiert, unter welchen Bedingungen auf den Microservice zugegriffen werden darf. Beispielsweise dürfen Vermögensverwalter nur auf die Daten ihrer eigenen Mandanten zugreifen. Auf die Kundendaten ihrer Arbeitskollegen haben sie keinen Zugriff.

Mit der Einführung von Microservices muss der Software Development Lifecycle (SDLC) effizient sein. Bisher genügte es, Anwendungen manuell zu kompilieren, zu testen und in Betrieb zu setzen. Mit der Auftrennung von Anwendungen in viele einzelne Microservices, kommen manuelle Tätigkeiten schnell an ihre Grenzen. Eine effiziente, automatisierte Bereitstellung von Anwendungen wird notwendig. Diese deckt sowohl die Softwareentwicklung mit CI/CD als auch die notwendige Infrastruktur (Infrastructure as Code (IaS)) ab.

Die Digitalisierung des Bankings erfordert neue Technologien wie Microservices, um die wachsenden Anforderungen seitens Kunden und Regulierer auch in Zukunft bedienen zu können. Die erfolgreiche Umstellung bisheriger monolithischer Systeme in die neue Welt ist jedoch ein komplexes Vorhaben. Setzt diese doch ein breites Wissen und Erfahrung in zahlreichen Disziplinen voraus (Service Orchestration, Data Management, IT Security, Automation). Mit den richtigen Experten gelingt Ihnen jedoch der Schritt in die Zukunft.

Ich freue mich auf Ihre Kontaktaufnahme