Lukas Kern

Partner

Krankenversicherungen: Mit durchgängiger Digitalisierung und Omnichannel-Fähigkeit des Offert- und Antragsprozesses zu zufriedeneren Kunden

Autor: Micha Boller

Jeweils im Herbst werden die Krankenkassenprämien kommuniziert. Die Customer Journey von potenziellen Neukunden beginnt mit der Recherche zu den Produkten und Preisen auf den Webseiten der Krankenversicherungen.

Für die Krankenversicherung eröffnet sich durch die digital eingereichten Anträge ein immenses Automatisierungspotential, worüber die Betriebskosten gesenkt werden können.

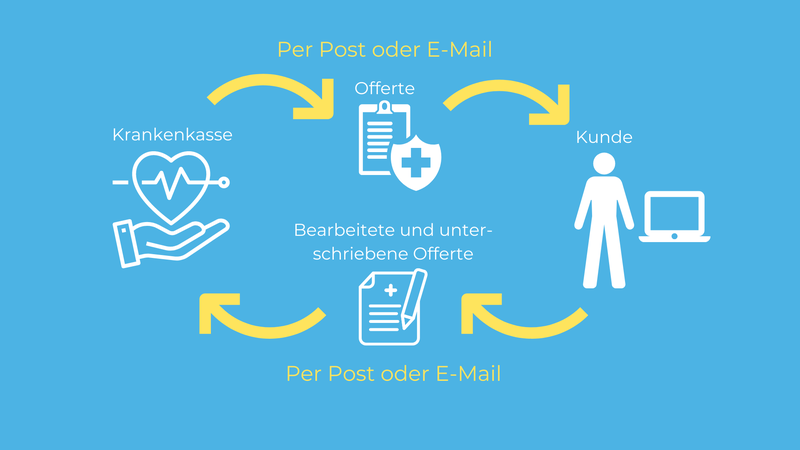

Der Kundenberater stellt dem Kunden in einem Beratungsgespräch eine Offerte zusammen, die der Kundenberater dem Kunden via E-Mail als PDF oder physisch per Post zustellt. Der Kunde druckt die Offerte meist aus, nimmt gegebenenfalls nochmals Änderungen an Produkten und Produktkriterien wie der Franchise vor und reicht die unterschriebene Offerte per Post bei der Krankenversicherung ein.

Die unterschriebene Offerte trifft bei der Krankenversicherung ein und wird als erster Schritt gescannt. Nun muss die Offerte durch einen Sachbearbeiter verarbeitet werden. Die ursprünglich konfigurierte Offerte muss gemäss der vom Kunden eingereichten Offerte im System angepasst werden. Weiter müssen die durch den Kunden gemachten persönlichen Angaben und beantworteten Gesundheitsfragen manuell aus dem Dokument ins System übernommen werden.

Soweit die Situation, wie der Offert- und Antragsprozess bisher abgelaufen ist. Der Prozess führt zu langen Warte- und Liegezeiten sowie zu Medienbrüchen beim Kunden und bei der Krankenversicherung.

Statt dem potenziellen Neukunden ein Offerten-Dokument zuzustellen, wird dem Kunden über einen beliebigen Kanal ein Link zum Online-Offerten-Rechner gesendet. Die initiale, während dem Beratungsgespräch erstellte Offerte kann so unmittelbar nach dem Beratungsgespräch vom Kunden eingesehen und nach den eigenen Wünschen nochmals angepasst werden. Der Kunde kann im Online-Offerten-Rechner die Produkte und Produktkriterien anpassen und prüfen, wie sich das auf den Preis auswirkt. Schlussendlich kann der Kunde in den Antragsprozess wechseln und den Antrag digital einreichen. Der Antragsprozess ist nahtlos in den Online-Rechner integriert und läuft so komplett digital ab. Kostenintensive Medienbrüche entfallen und die Customer Experience verbessert sich. Der Kunde kann jederzeit über verschiedene Geräte und Kanäle auf die Offerte zugreifen. Dadurch wird ein Omni-Channel Auftritt des Versicherers unterstützt.

Auch auf Seite der Krankenversicherung ergeben sich Verbesserungen. Eine nachträgliche Verarbeitung der physisch eingereichten Dokumente durch einen Sachbearbeiter ist nicht mehr notwendig, wodurch sehr viel Zeit eingespart wird. Der Antrag wird digital eingereicht und kann im Idealfall automatisiert policiert werden.

Mit der Umsetzung vom neuen Offerten- und Antragsprozess entsteht Business Value auf verschiedenen Ebenen.

Mit der Lösung wird die Customer Experience massiv verbessert. Der Kunde kann ohne Medienbrüche und Wartezeiten den Offerten- und Antragsprozess über verschiedene Kanäle durchführen.

Bestehende Systeme werden durch die Lösung ersetzt und somit die Zukunftsfähigkeit und Flexibilität sichergestellt.

Die Effizienz wird gesteigert, weil die aufwändige, manuelle Verarbeitung von physischen Anträgen reduziert wird.

Die Architektur reduziert die Time-to-Market von neuen Versicherungsprodukten, weil mit der gewählten Architektur Änderungen einfacher und schneller produktiv gesetzt werden können.

Mit dem API-Strategie Vorgehensmodell schaffen Sie ein einheitliches Kundenerlebnis über alle Kanäle hinweg.